vermont state tax exempt form

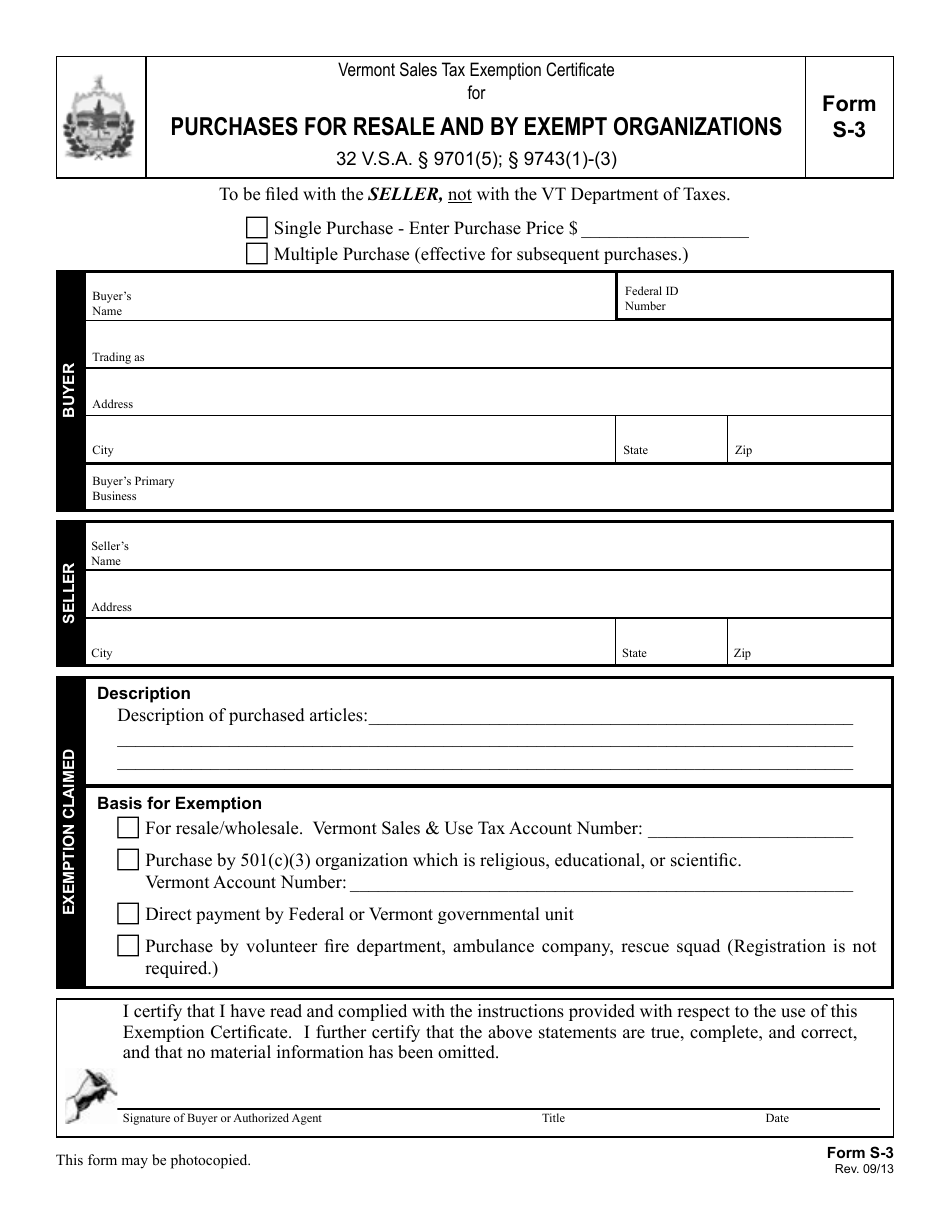

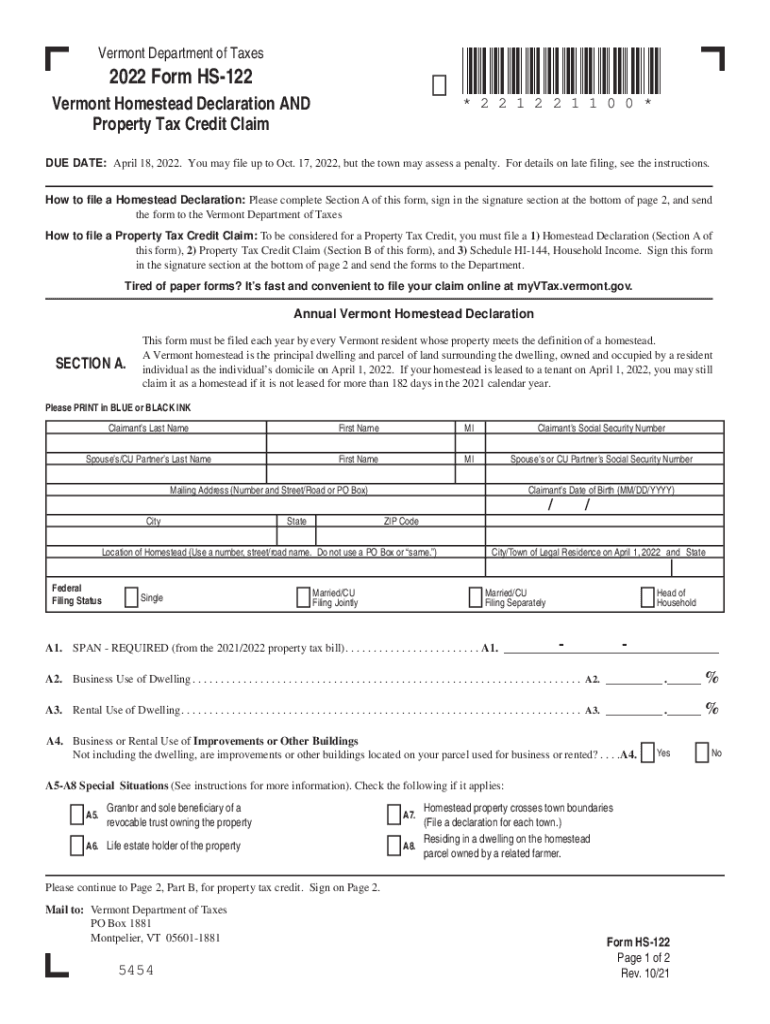

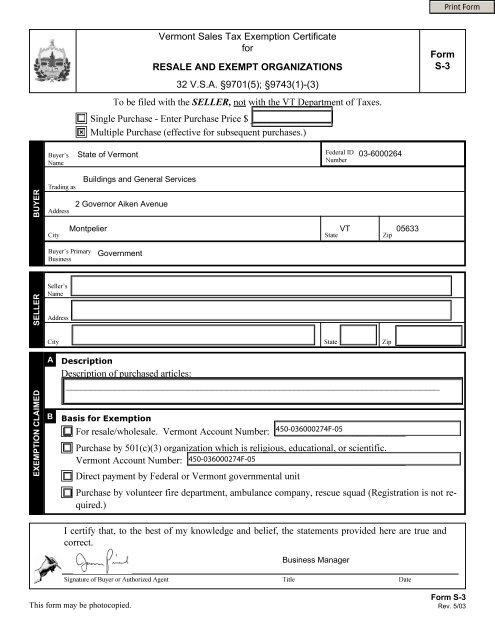

Step 1 Begin by downloading the Vermont Certificate of Exemption Form S-3. Form 990-T Exempt Organization Business Income Tax Return.

Vermont tax exempt form.

. Use a tax vermont exempt form 2019 template to make your document workflow more streamlined. Copies of the IRS form letters 1045 and 1050 indicating that youre eligible as a 501c3 organization. Vermont resale certificate verification.

53 rows No reciprocity with State of Vermont per 1-800-TAX-9188. 53 rows Present sales use tax exemption form for exemption from state hotel tax. Centrally Billed Account CBA cards are exempt from state taxes in EVERY state.

Certification is on an exemption form issued by. Vermont sales tax exemption nonprofit. Vermont Department of Taxation Additional information or instructions.

The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale. Limited items are exempt from sales tax.

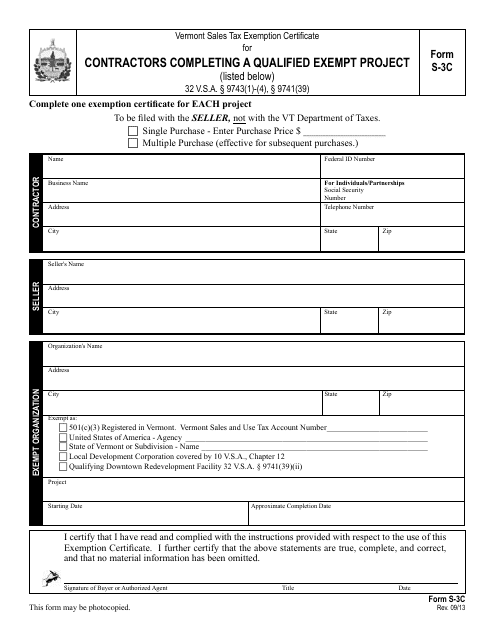

All other veterans are not exempt including veterans who may be 100 disabled. Use of this Short Form is not authorized and the Standard State Contract Form must be used if any of the following apply. Get form Security Number Telephone Number City State ZIP Code State ZIP Code State ZIP Code SELLER Sellers Name Address City Organizations Name EXEMPT ORGANIZATION Address City Exempt as.

Employee Self Service ESS and your paper W-4VT Vermont Tax Withholding elections please carefully consider whether you are eligible to claim EXEMPT. Out-of-state employeesPayroll and Tax Services needs to be notified of any paid employee student staff faculty or graduate student doing any portion of their work for UVM outside the. Certain states require forms for CBA purchase cards and CBA travel cards.

Ii the Maximum Amount is more than 24999. Of the filers 20000 in taxable Social Security benefits 16000 will be exempt from Vermont taxable income. Exempt Salary Request Form.

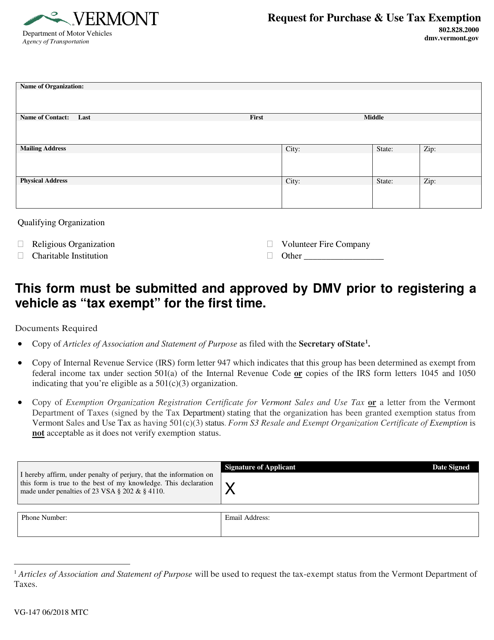

Veterans who meet these criteria are exempt from vehicle sales tax registration fees and license fees. Dental- Vermont Sales Tax Exemption Certificate for Purchases of Toothbrushes Floss and Similar Items of Nominal Value to be Given to Patients for Treatment. Department of Motor Vehicles - 802 828-2000.

Steps for filling out the S-3 Vermont Certificate of Exemption. Vermont Meals and Rooms Info Updated 112519. Tennessee TN Exempt from Sales and Use tax.

Vermont tax exempt form agriculture. Look for the worksheet in the instructions for Form IN-111 Vermont Income Tax Return. South Dakota SD No reciprocity with State of Vermont per 1-800-TAX-9188.

Do I need a form. The exemption reduces a taxpayers Vermont taxable income before state tax rates are applied. Go back to taxable income.

Line-by-line instructions for complex tax forms can be found next to the file. 8868 Extension Tax Extension Form for Nonprofit tax returns 990 Extension Form 8038-CP NEW. Vermont Sales Tax Exemption Certificate for Manufacturing Publishing Research Development or Packaging.

802 828-2551 Important links. You may claim a tax credit for a vehicle registered to you for a period of 3 years or more in a jurisdiction that imposes a state sales or use tax on vehicles. File your return electronically for a faster refund.

You will be required to prove that the vehicle was registered in a qualifying jurisdiction. ˇ ˆ Form S-3C Rev. Exempt does not apply to Social Security or Medicare taxes.

Form S3 Resale and Exempt Organization Certificate of Exemption is not. Vermont Sales Tax Exemption Certificate for Fuel or Electricity 32 VSA. You will be required to submit a completed Certification of Tax Exemption form VT-014 Vehicles previously registered out-of-state.

Vermont Sales Tax Exemption Certificate for Fuel or Electricity. Vermont tax exempt form s-3c. I the Contract Term is more than 12 months.

Pin On Tennessee Forms. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. A previous Vermont or out-of-state title indicating the applicants ownership.

Go to myVTax for more information. South Carolina SC x No Exemption based on the status of the purchaser. Vermont Sales Tax Exemption Certificate Who do I contact if I have a question.

With US Legal Forms you can select from 85000 state-specific templates. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. Follow the step-by-step instructions below to eSign your vermont sales tax exemption certificate form.

Short Form - Return of Organization Exempt From Income Tax. Copy of Internal Revenue Service IRSform letter 947 which indicates that this group has been determined as exempt from federal income tax under section 501a of the Internal Revenue Code. Vermont Department of Taxation.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and. Vermont Invoice of Handyman To ensure the validity of your documents make sure to use proper legal forms. 280 State Drive Waterbury Vermont 05671-1010 Phone.

S tep 2 Check whether the certificate is for a single purchase or multiple purchases. For purposes of the exemption from the Meals and Rooms Tax the State of Vermont shall mean the state any of its agencies instrumentalities public authorities public corporations political subdivisions cities towns school districts and Vermont state colleges including the University of Vermont. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Iii the Scope of Work involves life safety transport of persons hazardous materials construction data usage or sharing access to confidential information. For more information contact the Vermont Department of Motor Vehicles. To qualify as exempt the State must be charged or billed in its own name.

C 501c3 Registered in Vermont. When you use a Government Purchase Card GPC such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state sales tax. How to fill out certificate of exemption.

If the retailer is expected to be purchasing items frequently from the seller instead of completing a resale. Centrally Billed Account CBA cards are exempt from state taxes in EVERY state. Form S-3F can be found on.

Claiming EXEMPT on either or both forms means that 0 Federal and or State taxes will be withheld from your wages. Do I need a form.

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Fillable Online Vermont Sales Tax Exemption Certificate For Form Resale Fax Email Print Pdffiller

State Corporate Income Tax Rates And Brackets Tax Foundation

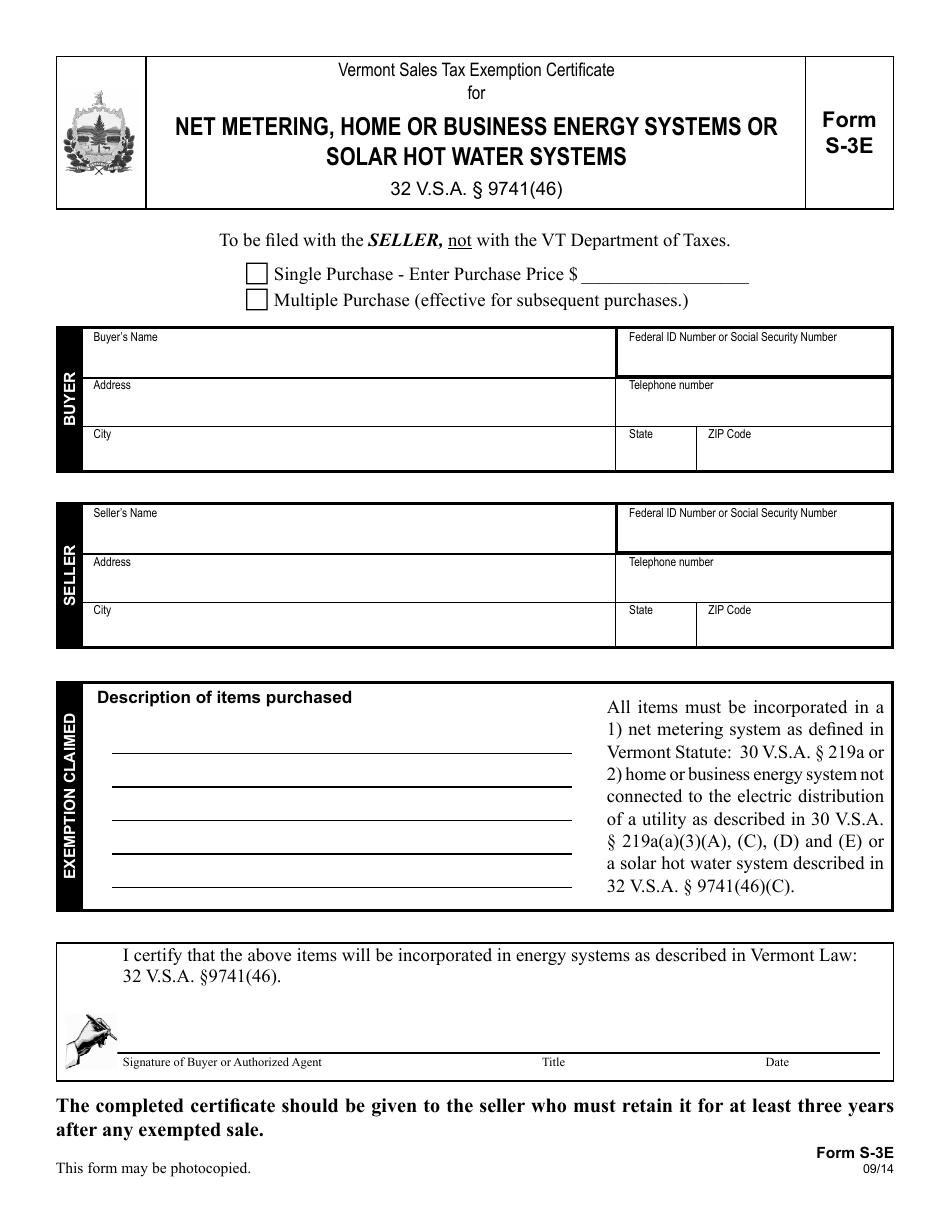

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

Printable Vermont Sales Tax Exemption Certificates

/cloudfront-us-east-1.images.arcpublishing.com/gray/CXD4DYGLZBCTZGMYMGPSNK3IVI.jpg)

Scott Signs Tax Exemption Bill For Tribal Lands

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vt Form Hs 122 2022 Fill And Sign Printable Template Online Us Legal Forms

Vermont Sales Tax Exemption Certificate For Form S

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller