what is fit on a pay stub

Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. You will pay this tax on all your earnings up to 137700.

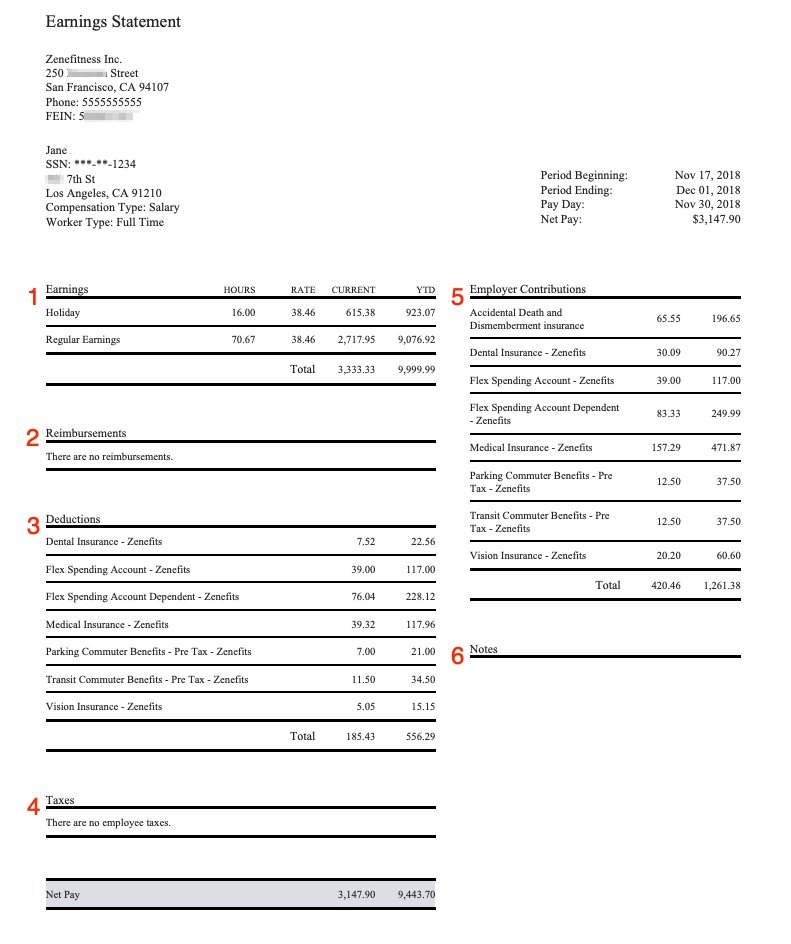

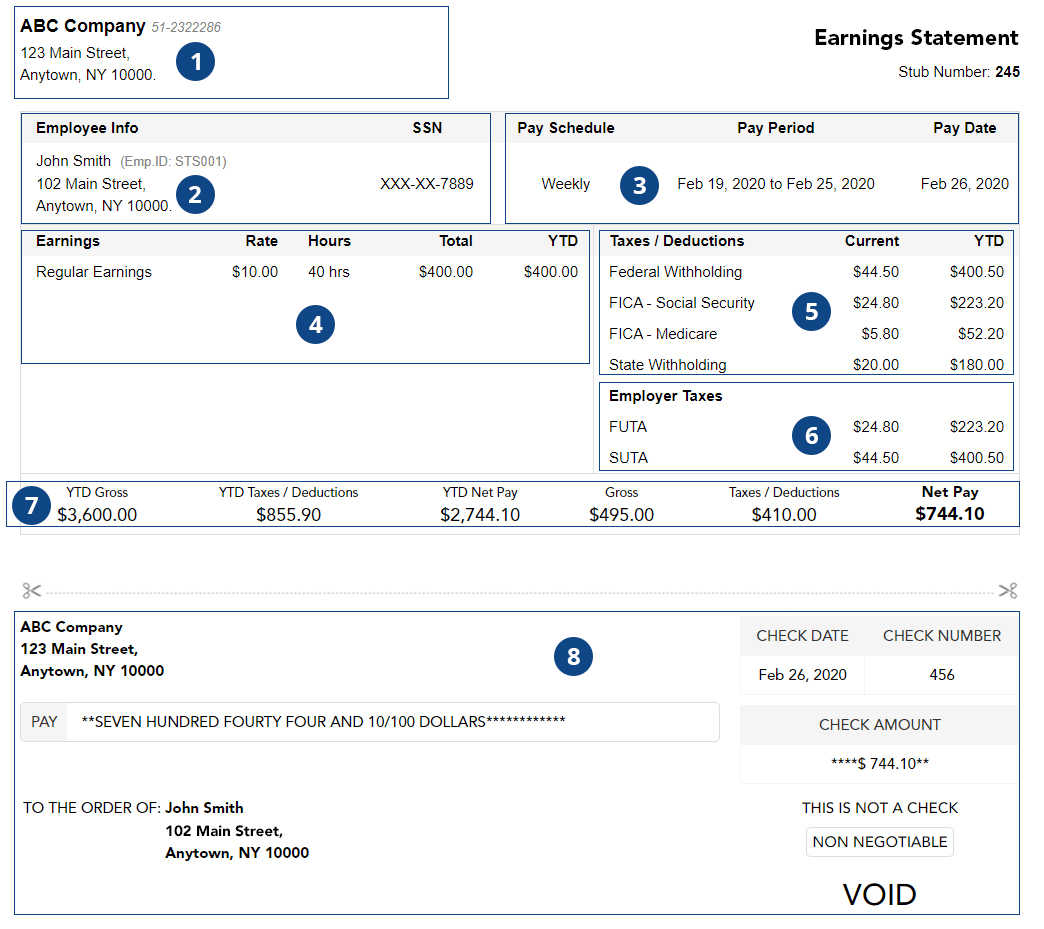

Sample Pay Stub Opportunities For Wbc

Pay stubs attest to the fact that both the company and the employee have agreed on a payment system.

. Compupay is an online payroll accounting service that. Answer 1 of 2. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn.

In the united states federal income tax is determined by the internal revenue service. Some are income tax withholding. When you reach this amount of money earned you no longer pay this tax.

In the United States federal income tax is determined by the Internal Revenue Service. Personal and Check Information. FIT stands for federal income tax.

The taxable wages are likely less than his actual salary because of pre-tax deductions health insurance retirement investments etc which reduce his taxable income. The rate is not the same for every taxpayer. The percentage method is based on the graduated federal tax rates 0 10 12 22 24 32 35 and 37 for individuals.

FIT is applied to taxpayers for all of their taxable income during the year. Some payroll companies use their own set of these abbreviations while some dont. Fit FIT.

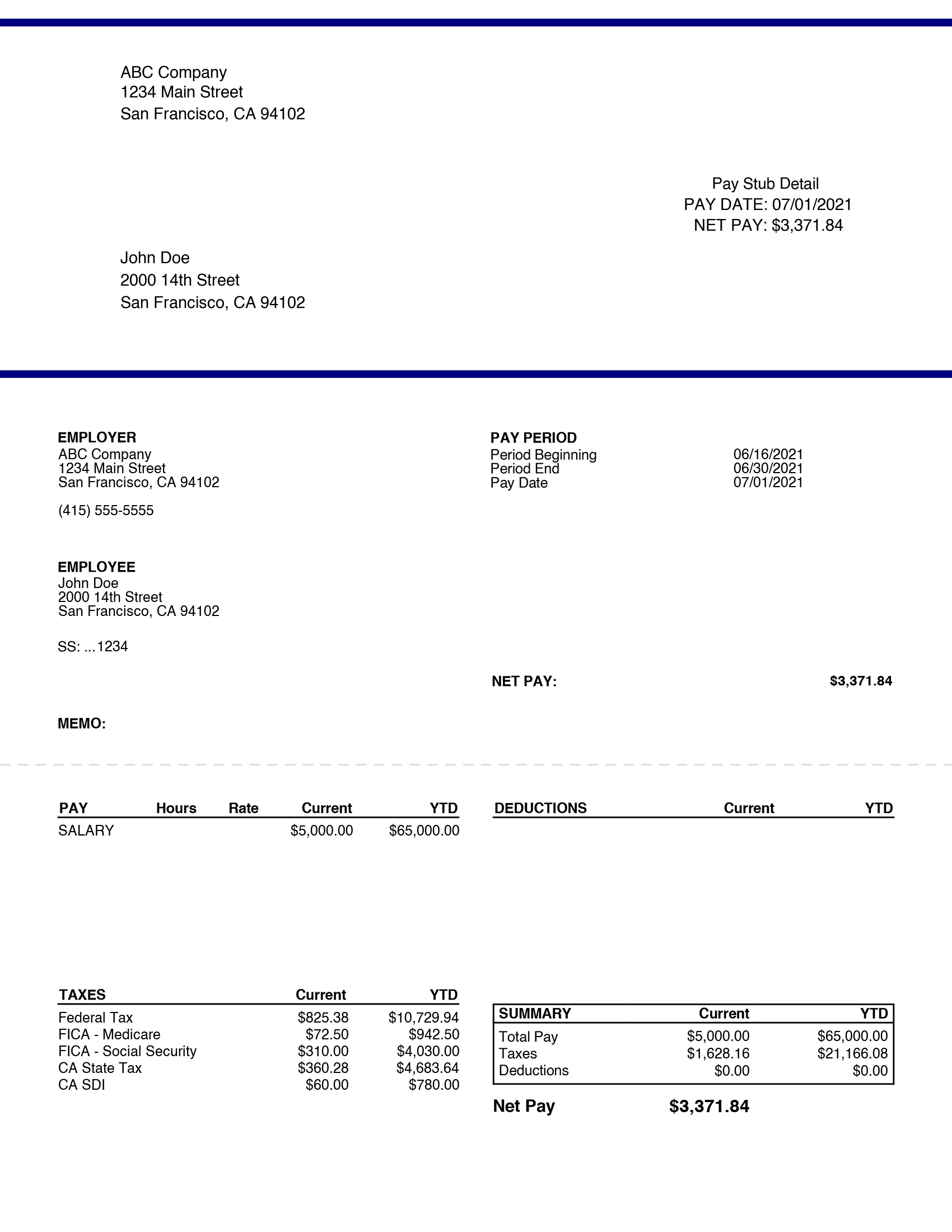

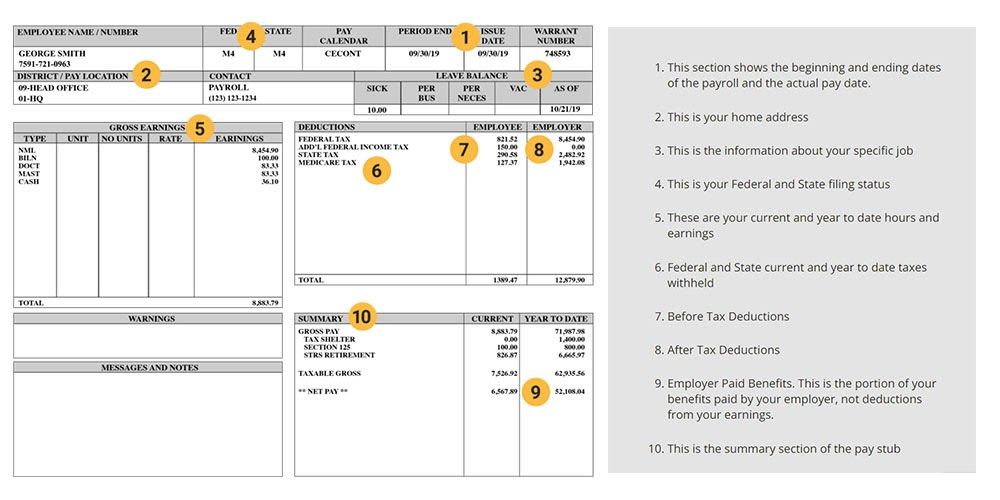

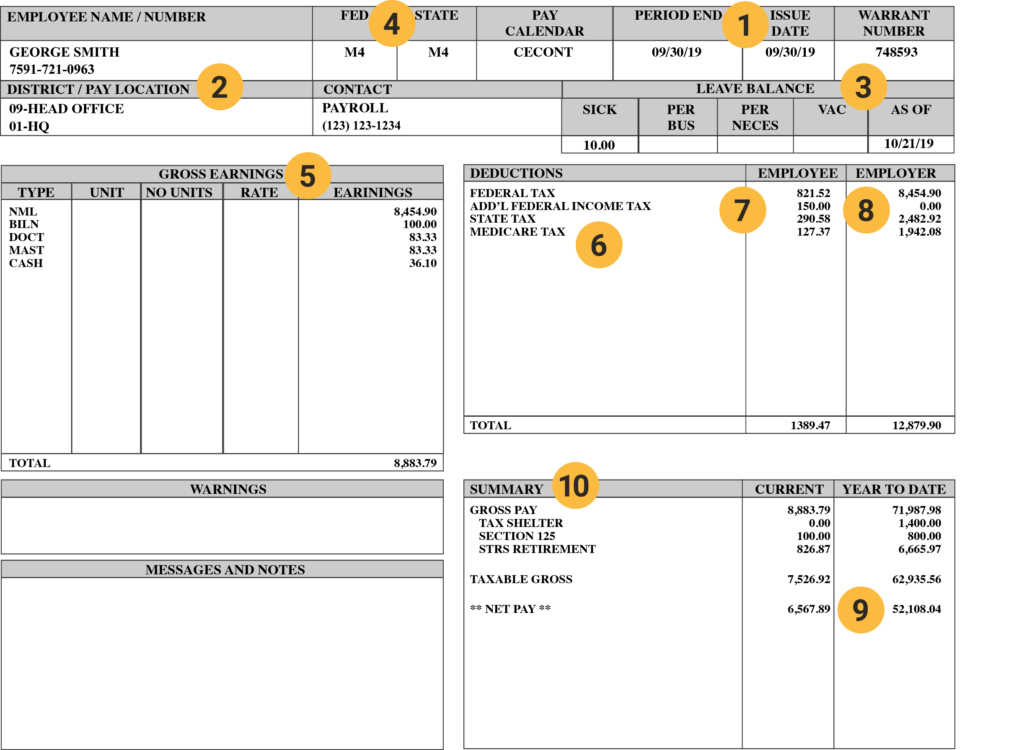

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an earnings statement. This is the information about your specific job. The FIT gross is what I would expect to see in Box 1 of the W-2.

On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their employees. You will receive a pay stub for each pay period. Add Pay Additional pay.

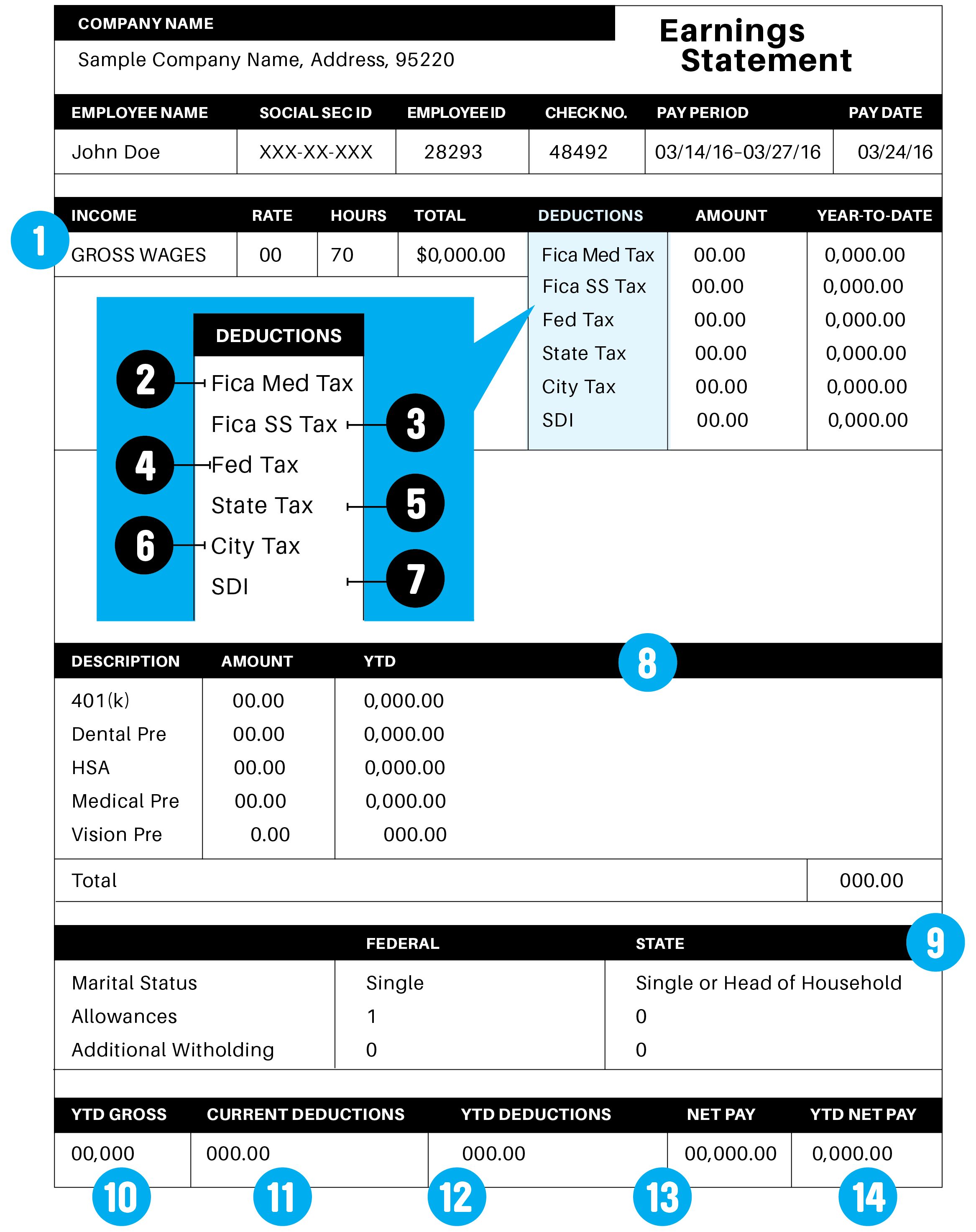

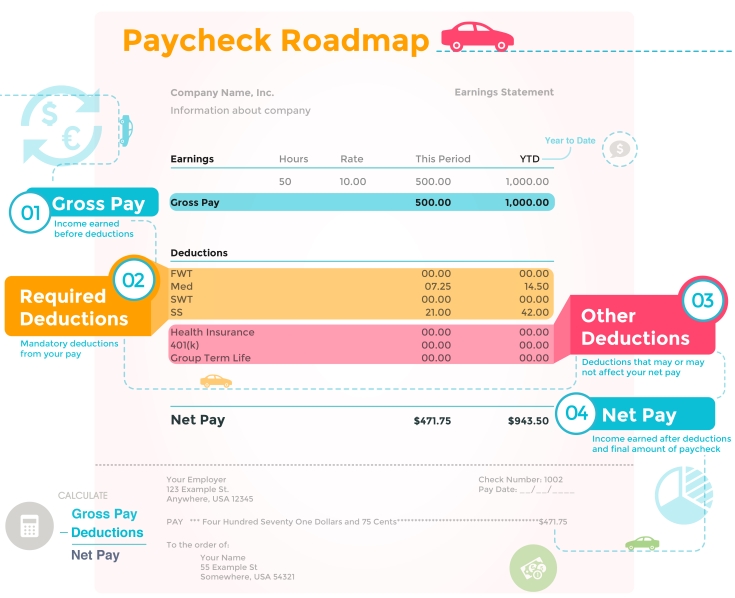

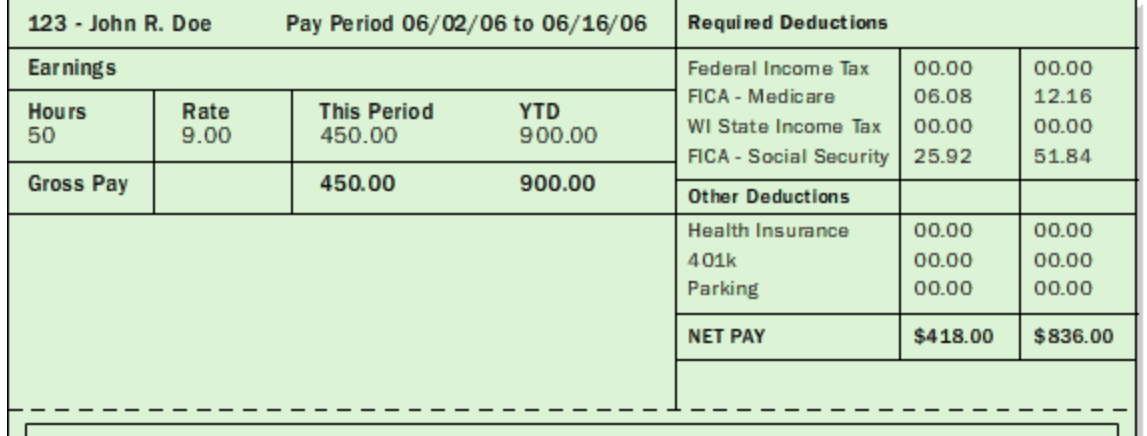

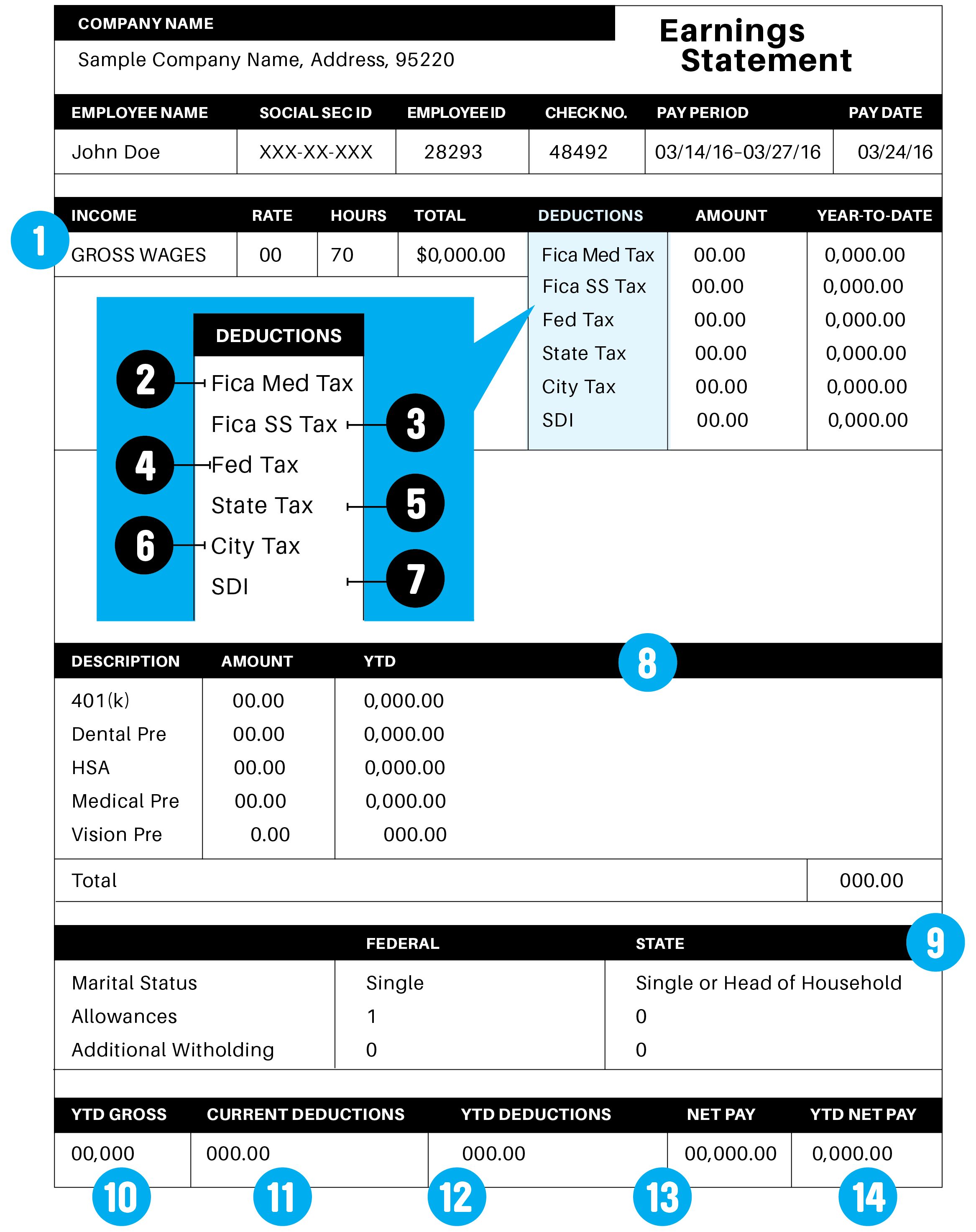

Knowing what is. Paycheck stubs are normally divided into 4 sections. Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it easier for them to fit a lot of information on a single sheet of paper.

Pay stubs are created in conjunction with paychecks so each employee gets a new pay stub for each pay period. Withholding is one way of paying income taxes to the. FIT Fed Income Tax SIT State Income Tax.

The employee is responsible for this amount and the FIT tax is. Here is a list of paycheck stub abbreviations that relate to your earnings. Some entities such as corporations and t.

BRVMT Bereavement pay. You will pay this tax on all your earnings up to 137700. The FICA taxes for Medicare are equal to 145 of your gross earnings.

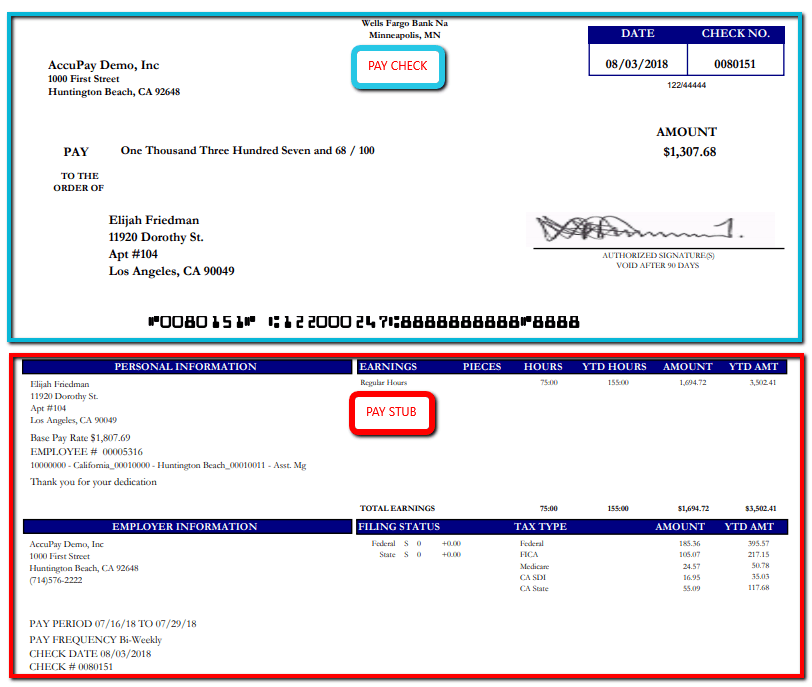

There is no cap on earnings for Medicare. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may. Below is a sample paycheque and pay stub.

It shows your total earnings for the pay period deductions from the total and your net pay after deductions. How to Read a Pay Stub An Example Pay Stub. Without understanding the difference youll struggle to get the full picture of what your pay stub is telling you.

The Reason Behind Giving Your Employees Pay Stubs. Social Security or Social Security Tax Withheld. Fit stands for Federal Income Tax Withheld.

These items go on your income tax return as payments against your income tax liability. What companies offer online payroll accounting services. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Op 4 yr. State Tax or State Tax Withheld.

TDI probably is some sort of state-level disability insurance payment. FIT tax is calculated based on an employees Form W-4. Cmp Pyot Compensatory time payout.

Federal Tax or Federal Tax Withheld. Employers withhold FIT using either a percentage method bracket method or alternative method. The FICA taxes you pay for Social Security are equal to 62 of your gross earnings each pay period.

Common Abbreviations Used on Paycheck Stubs. To use a paycheck calculator program you only need to provide information such as the business name and your salary details. Federal Income Tax.

In short gross pay is the amount of money youre paid BEFORE taxes. One of the real secrets to how to read your pay stub is knowing what distinguishes your gross pay from your net pay. Pay Stub Abbreviations are the abbreviations that you come across on any pay stub.

A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid. FICA taxes are payroll taxes and they are. Your net income gets calculated by removing all the deductions.

The use of a pay stub generator is easy and takes less than two minutes. This is your home address. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

Federal income taxes or FIT is calculated on an employees earnings including regular pay bonuses commissions or other types of taxable earnings. FIT tax refers to Federal Income Tax. What Information is Included on a Pay Stub.

What Is Fit On A Pay Stub. This section shows the beginning and ending dates of the payroll and the actual pay date. CNT Pay Contract pay or your salary Hol Holiday pay.

The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you.

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Hrpaych Yeartodate Payroll Services Washington State University

Free Packing Pay Stub Template Excel Word Apple Numbers Apple Pages Pdf Template Net

Sample Pay Stub Templates Mr Pay Stubs

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean

Direct Deposit Pay Stub Template Free Download Printable Templates Lab

Understanding Your Paycheck Credit Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Create Pay Stubs Regular Pay Stub Professional Check Stubs

Paystub Excel Template The Spreadsheet Page

Understanding Your Paycheck Harmon Street Advisors

The Ultimate Check Stub Template Monday Com Blog

Understanding Pay Stub Understanding Paycheck Stub

Common Pay Stub Errors California Employers Should Avoid

What Everything On Your Pay Stub Means Money

A Guide On How To Read Your Pay Stub Accupay Systems

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto